Table of Contents

What Does Money Transferring Mean?

In simple words, money transfer is transferring money from one bank account to another bank account. It can be a physical or electronic fund transfer from one bank account to another bank account. It may occur between the same bank operators, different bank operators, in the same country, in different countries.

This is the act of transferring money from one place to another place either in the same country or overseas. When it occurs in the same country known as a domestic money transfer and when it occurs in overseas known as an International or global money transfer.

Basically, money remit is used for electronic fund transfers. This is the cashless mode of transferring money from one bank account to another bank account.

What are the Different Types of Money Transfer?

There are plenty of ways of transferring money from one bank account to another bank account. As technology is growing, it becomes very easy to transferring money. Today you can transfer money by one click, anytime anywhere.

Here we are discussing the top 3 trending ways of transferring money.

- NEFT

- RTGS

- IMPS

NEFT (National Electronic Fund Transfer)

NEFT or national electronic fund transfer is the easiest and most liked way of transferring money from one bank account to another bank account.

To transfer money using NEFT, you need two important pieces of information, first is the account number and second is the IFSC code of the receiver’s account.

There is no limit of money remit through NEFT, however Individual banks set the limit.

This is the smother way to transferring money which is generally used by us through the money transfer app.

Steps for NEFT fund transfer

Step 1: Go to fund transfer function and select transfer to another bank

Step 2: Fill up recipient account details & IFSC code

Step 3: Accept terms and conditions

Step 4: Complete the process and check report

RTGS (Real Time Gross Settlement)

RTGS is quite similar to NEFT, but the minimum amount limit and how to credit it to the receiver account are different.

You can use RTGS as a real-time fund transfer service. It takes almost 30 minutes to transfer. There is no upper limit of transferring amount.

Steps of RTGS fund transfer

Step 1: Go to fund transfer tap and select transfer to another bank

Step 2: Fill recipient account details and related information

Step 3: Accept terms and conditions

Step 4: Complete the process and check report

IMPS (Immediate Payment Service)

As per the name, IMPS is the fastest money transfer service now a day. You can use this service at any time. We can say it is the combo of NEFT and RTGS.

To avoid the fraud transactions, it has set a low cap of transaction limit. You require recipient phone number and account details to transfer funds.

Steps of IMPS fund transfer

Step 1: Use your customer ID and Password for login into mobile banking

Step 2: Go to the fund transfer tab

Step 3: Select debit/credit account, mode of transfer as IMPS and beneficiary account

Step 4: Enter the amount to be transferred & click to submit

Step 5: Click on the confirm button

Step 6: Double-check all the information and approved the transactions using OTP received on the registered number & check the report

Using IMPS, you can transfer money 24*7 anytime anywhere whereas NEFT and RTGS occur in working hours.

These are types of money remit services through which you can transfer funds online using account details. Along with these, you can transfer money through UPI and cheque. In UPI (Unified Payments Interface) you don’t need recipient account details, you can transfer money through register mobile number linked with Individual bank accounts. For ex. Paytm UPI, Google Pay etc.

Advantage & Disadvantage (Pros & Cons) of Money Transfer?

Money transfer is the most trending service now a day. There are many advantages of fund transfer, but it has some scarcity. Let us see some advantages and disadvantages of it.

Advantage of Money Transfer

- It is Fast, Safe & Secure Process

This is a digital era and money remit is the fastest fund transfer facility today. You can transfer your fund from one bank account to another bank account by just click. Along with speed, it is safe to process because it works under NPCI and RBI.

- Flexibility and Convenient

It is a flexible and convenient way of transferring money from one bank account to another bank account. You can use this anytime, anywhere by just one click.

- Low Surcharge

To transfer money from one bank account to another bank account you have to pay a small piece of the amount which is known as a low surcharge. You can transfer money at a low surcharge in India. If we talk about international fund transfer it charges a low exchange rate across country lines.

- Cashless Transaction facility

Money remit eliminates all paper works which used in physical banking. Through the electronic fund transfer process, you can transfer funds online without going across paperwork. You don’t need to carry a big amount on your pockets when you are traveling. You can directly get it in your account by paying a small amount.

So these are some view which shows an advantage side of electronic fund transfer. Now it time to turn the opposite. Here we go through some scarcities of this wonderful service.

The disadvantage of Money Transfer

- You have to pay to online services

As we discussed, we have to pay a small piece of the amount to banks to transfer the money. Sometimes when you use online money remit services, you have to pay an extra small amount to these services in return for online fund transfer. But this is not a big problem I think, because by using these services you can transfer money fast.

- Doubts of Fraud through Credit/Debit Data (Not Secured)

Sometimes hackers misuse your data when you are using credit/debit cards to perform online transaction activity. They can steal your Id and password from the machines and can use it to hurt your bank account.

- Sometimes technical difficulties can suffer you

Sometimes due to technical loops, you have to suffer but this is occasionally.

How Does Money Transfer Works?

There are very simple steps to money transfer through mobile apps or money remit software. In the above paragraph, we have discussed online fund transfer through mobile applications. Here we discuss the fund transfer process through money transfer software.

Step 1: Visit nearby money remit agent or service provider

Step 2: Register remitter account through your name, mobile number and give him cash amount

Step 3: An OTP will come to your mobile number through which you authenticate your remitter account

Step 4: Now you to provide receivers bank details like name, account number, and IFSC code

Step 5: Agent will register the beneficiary account of the receiver

Step 6: Fill the amount you want to send into the beneficiary account

Step 7: Now agent gets an OTP and after submitting OTP, transactions occur

Step 8: Get transaction receipt from the agent

So these are the steps which you have to follow to transfer money. In return of fund transfer, the agent can charge you a piece of an amount which totally depends on the agent. Different agents charge a different amount for money transfer service but this is very nominal.

How Much Can You Transfer in One Day?

Most of the people are confused about this. Actually there is no fixed limit to transferring money. You can transfer money from a very small amount to 10 lac per day.

- Payment gateway transaction limits up to 10 lac per day/ per transaction.

- If we talk about the personal account, you can transfer any amount which you have.

- If we talk about IMPS, you can transfer up to 2 lac to register a beneficiary account

- NEFT allows you to transfer funds to a beneficiary account up to 10 lac, if your beneficiary account is a new register, you can transfer up to 5 lac and If your account is registered under 24 hours, you are allowed to transfer 50,000 rupees.

- RTGS also allow up to 10 lac/per day to beneficiary account (It take 24 hours to transfer)

- You can transfer up to 50,000 without register beneficiary account through mobile banking

- If you have a new device and new register net banking, you can transfer up to 10,000 without register beneficiary account

Note*- So these are some basic limits of transfer money through these services. But If you are money transfer agents, your fund transfer limit depends on your bank operator.

What is Money Transfer Business?

Some years ago, fund transfer is only done by banks through physical money transfer. As the technology is growing, money remit service becomes advanced. There are many places in India where banks are unable to reach. To bring all the society at the same financial platform, banks start a policy. In which they provide you the authority to offer money transfer service in a legal way. You can start your own money remit agency as private and can offer fund transfer services.

But to get the authority through these banks you to fulfill their terms and conditions. If I talk about us, it is almost impossible for us, but don’t worry, I have the solution.

There are many software development companies in India that offer money transfer software integrated with money transfer API.

In short, you can start your own online fund transfer agency through all bank money transfer software.

Which is the Best Money Transfer Software Provider Company in India?

There are many money transfer software provider companies in India which claim to be best. I would like to suggest you choose the best money remittance software Provider Company for the money remit business.

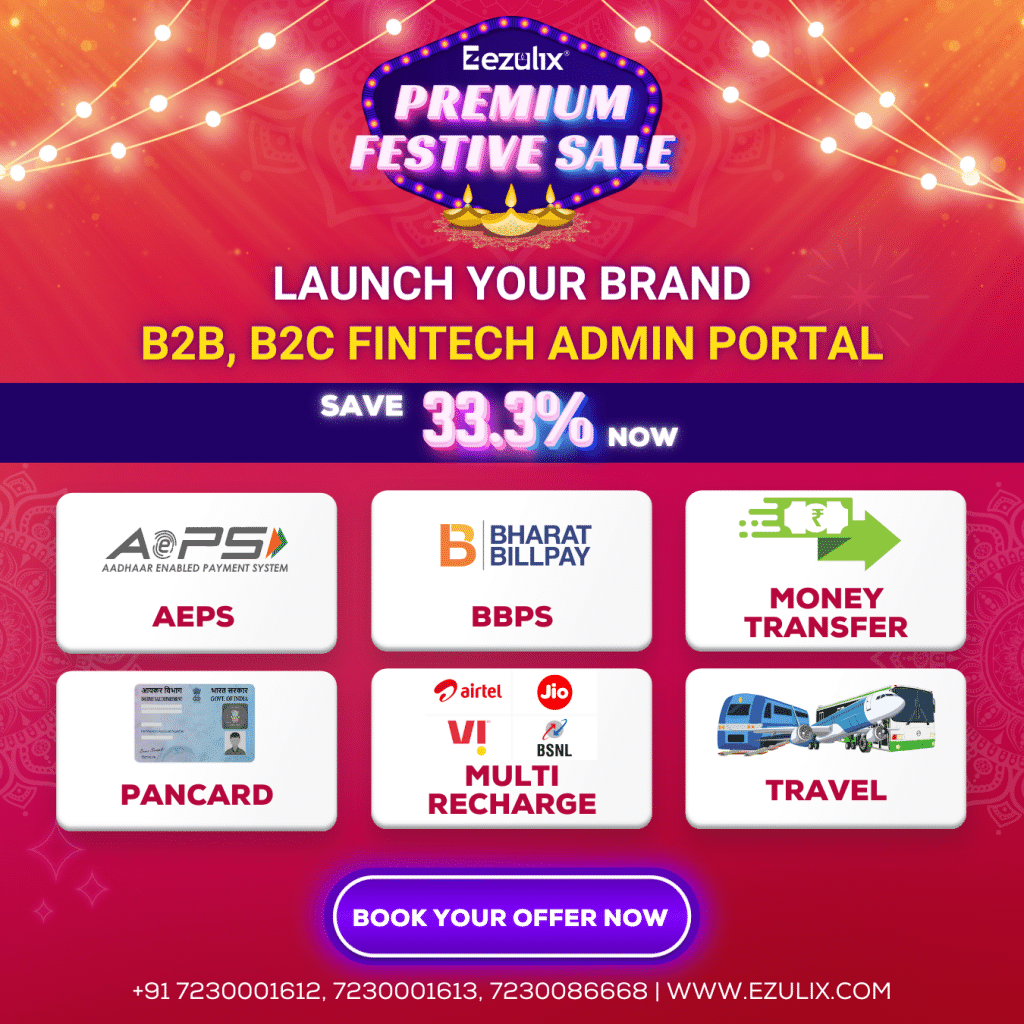

Ezulix software is one of the best software development company in India. We provide you new technology-based advanced money remittance online software that fulfills all the aspects of the money remit business.

We are leading money remittance software providers over the last few years this is the reason today we have thousands of happy customers all over India. Our belief is in the best service and support which makes us different from others.

What are the Features of Ezulix Money Transfer Software?

- Our fund transfer software is cost-effective

- Advanced money remittance software with unique features

- It is fast, safe and secure through safe payment gateway and API

- User-friendly and SEO-friendly portal

- Instant fund transfer service

- Lowest surcharge in the market

- Create unlimited agents

- Real-time settlement in Wallet

- The transaction receipt for fund transfer

- You can transfer fund to any bank operator

- 100% success ratio

- Free mobile app for fund transfer

- Best customer support service

These are some features which can help you to understand about money remit software.

How to Start Money Transfer Business in India?

If you are planning to start your own online fund transfer agency and looking for the best money transfer business software then this can be a great business startup opportunity for you. You can start your own online fund transfer business with Ezulix advanced money transfer online software and can make it a handsome source of Income.

We provide you stander money remit software with the latest features. You can start your own money remittance agency with us as Admin. You can create unlimited authorized money remit agents all over India as –

- Master Distributor

- Distributor

- Retailer

Whenever an agent is done the transaction, you earn a small piece of the amount as a commission with your team. Although we provide you a stander portal, along with money remittance, you can offer online recharge service, AEPS service, pan card service, mPOS, and bill payment service to your members and can earn maximum profit.

To start a money remittance business with us, you have to apply for a free live demo. Our executives shortly contact you and provide you manual training so that you can understand the software and business. It helps you to use it at an optimum level.

Final Words

So here we discuss all you need to know about electronic fund transfer, its types, services, advantage and disadvantage, money remittance software and how can you start your own money transfer business in India which best money remittance business software provider company in India.

I hope you will love this article, if you have any query or I missed any topic, please comment. In the next article, I would like to complete all your queries. If you want to support this article and think it may be beneficial, please share it with your friends, family and your social media accounts.

34,648 total views, 9 views today

Comments are closed.