When we talk about 19th and 20th century, people loved to deal in cash. They had to visited to banks & ATMs and stand in long queues for financial transactions like cash withdrawal, cash deposit, balance enquiry etc. But now we are living in 21st century, the era of technology that is impacting every sector of society. Indian banking landscape has changed and today people don’t wants to spend time in queues and believe in technology & automation. At this time Aeps Software comes in action to resolve their banking hustles for offering easy & secure financial services.

In this blog, we will discuss about Aeps Software and how it is helping individual as well as businesses in seamless banking.

Table of Contents

What is Aeps Software & How It Works?

Aeps stands for Aadhaar enabled payment system. Aeps Software is a digital payment platform that allows a bank customers to perform basic banking transaction using unique Aadhaar authentication.

This Aeps System is a combination of financial services & technology. It is evolution of traditional banking system to a smart, powerful and secure financial era.

When a strategically design software integrate with banking APIs, it becomes an amazing payment solution that speed up banking with less cost and higher out.

NPCI started Aeps to penetrate banking services in all over India where banks and ATMs are not available and this Aeps Software done this work for it.

How It Works

To use this AEPS software for banking, a bank customer needs Aadhaar card and finger print authentication. They can performs all basic banking transactions like cash deposit, cash withdrawal, mini statement, money transfer and balance enquiry by using it.

To perform all these transaction you have to visit your nearby BC (Business Correspondent) who has access of this software to use it for banking services.

Do you know who is this BC?

Actually this system works as B2B type and BC is the tail of this system who directly interact with customer and offer services.

This system starts by NPCI who manage and regulate all the system. NPCI direct banks to provide banking API to companies who develop Aeps b2b Software. This software companies integrate these APIs into software and develop this comprehensive solution

Further these companies offer this solution to fintech entrepreneurs who wants to start their own fintech company. They are known as Admin.

These admins has complete control on this Aeps admin software. They can customize it, Create members in down line like master distributor, distributor and retailers (BC), create packages and commission structure.

Admin offers services to down line and they further provide it to customers and complete system earn profit against it.

Benefits of Using Aeps Software for Individuals?

In this section we will discuss, how Aeps Soolution is helping individuals in their daily life.

- As we known Aeps is Aadhaar based payment system that allows individuals to visit without a debit and internet banking. Anyone can access banking using this anytime, anywhere. Now bank customers don’t need to be access major banking transactions in banking hours.

- Most importantly people has stand in long queues for basic banking transactions like cash withdrawal and balance enquiry. Now they can access banking services by visiting their nearby business correspondent. Especially people who lives in rural areas has big edge of this system.

- As we known banking is a very sensitive matter and a small mistake can lost your lifetime earn. This system make sure higher security and multi factor authentication that make this system reliable for banking needs.

So these are major benefits that are helping individual to make their banking needs fulfil seamlessly.

Benefits of Using Aeps Software for Businesses?

As a business perspective, Aeps software plays vital role in Fintech Start-ups. It allows you to start your own brand b2b fintech company in India and earn Aeps commission by offering all basic banking services.

Aeps software is a comprehensive solution for b2b Fintech Admin Business. To start Aeps business, you have to find Aeps Software Provider Company.

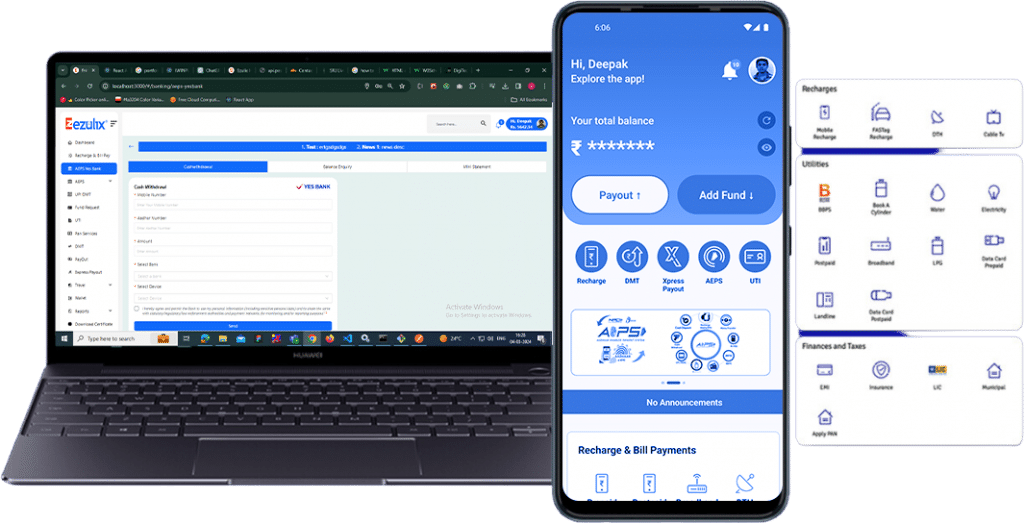

I would like to suggest you to choose Ezulix Software, as one of the best Aeps software development company. We have served more than 2500+ businesses and support them to start, run and explore businesss.

Aeps software company provides you manual training of Aeps admin panel so that you can use it optimum level. Now you can run your own brand fintech company, you can create members all over India and can earn profit by offering all Aeps services to customers through your network.

Although this is a service industry, you will face many issue like customers complaints. To resolve this, you Aeps software provider offers you a channel like mail support or any ticket system that allows you to resolve all your customers issue.

Key Features of Aeps Software You Must Know

Check out key features of Aeps Software that makes it valuable.

- Multiple Bank Services – By using Aeps Software, admin can offer multiple bank Aeps services. It means zero down time which enhance customer seamless banking experience.

- Easy to Use Interface – Unique and easy to use Aeps admin portal interface boost user experience. Aeps application with clear navigation and fast loading speed help businesses to grow.

- Real-Time Transaction Report – Aeps software allows you to get real-time transaction report receipt.

- Commission Management – Admin can track all commission reports on daly basis as well as weekly and monthly basis.

- Reporting & Analytics – Along with instant report, this system allows you to check all analytics based on time, & location. It also helps you in strategy formation for future.

- Security Measures – This Aeps b2b software is a highly secured banking system that make sure to keep all user details secret and hidden.

- Fully Customized – Last but not the least, admin can customize their system accordingly. He can make many changes based on business needs. He can check all important reports on dashboard and keep complete system streamlined.

So these are all key features that make this Aeps software system highly potential.

The Future of Aeps Software

When we started a survey to local daily banking customer, we found few common points like-

- People are showing interest in this cashless banking system

- Along with Aeps, Micro ATM also helping individuals as well as businesses

- People are not interested having cash now

- They don’t have time to visit and stand in long queues

- In rural areas people are now contributing in Indian economy by using banking through Aeps

- People are directly getting government facilities in bank account through this Aeps system

- According to last Feb 2023, Aeps transactions was almost 450 Million and this data is increasing daily

Moral of the story is this AEPS system is the blockbuster story of 21st century in financial sector and many more super hit chapters are still about to come.

2,533 total views, 1 views today