We are a dedicated B2B AePS Software Developer that provides client-focused AePS Software Development Solutions. So, if you are a FinTech business or an emerging or aspiring FinTech startup, then our AePS Software development services are just for you!

We craft reliable AePS B2B Software for aspiring AePS admins . So, choose Ezulix as your AePS Software Development partner and get authentic AePS software development services.

Operating the AePS Software is quite simple. Also, Starting a FinTech business with our AePS Software is also a simple process. All you need to do is-

1. Get AePS Software from Ezulix.

2. We shall implement the Software in Your System.

3. Now, we shall register you as an admin and create a Login ID and Password for you.

4. You may change the password later.

5. After finalising the login credentials, you will get access to the AePS Admin Panel.

6. Ezulix will guide and train you thoroughly on the robust features of our AePS Admin Panel.

7. After the training, you can start adding the software distributors and their subordinates.

8. You, with all access to the AePS Admin Portal, will act as the central authority.

9. Also, you have complete freedom to register the distributors and their subordinates.

10. You can provide them with the Login ID and Passwords and add profiles individually for all of them.

11. Once, the registration of your distributors and their subordinates is complete, you can start providing Adhaar enabled Payment System to their place.

12. Furthermore, you will continue to have access to the AePS Admin Portal throughout the span of your business. Eventually, you can access and monitor each transaction they execute.

13. Additionally, you will also be entitled to receive a commission, the time a customer avails of the AePS services from a subordinate.

14. Also, you can control the commission share as per your requirements.

15. Not only this but also you can control the commission share for the distributors and subordinates. (Yes, they too will benefit from our AePS Software)

16. Moreover, you can access insightful data analytics reports anytime on the provided AePS Admin Panel. This will help you to formulate business strategies for future expansion.

We provide not only the AePS Software, but we help you establish as a complete FinTech business. We would also provide you with all the other business essentials when you take AePS Software Development from us

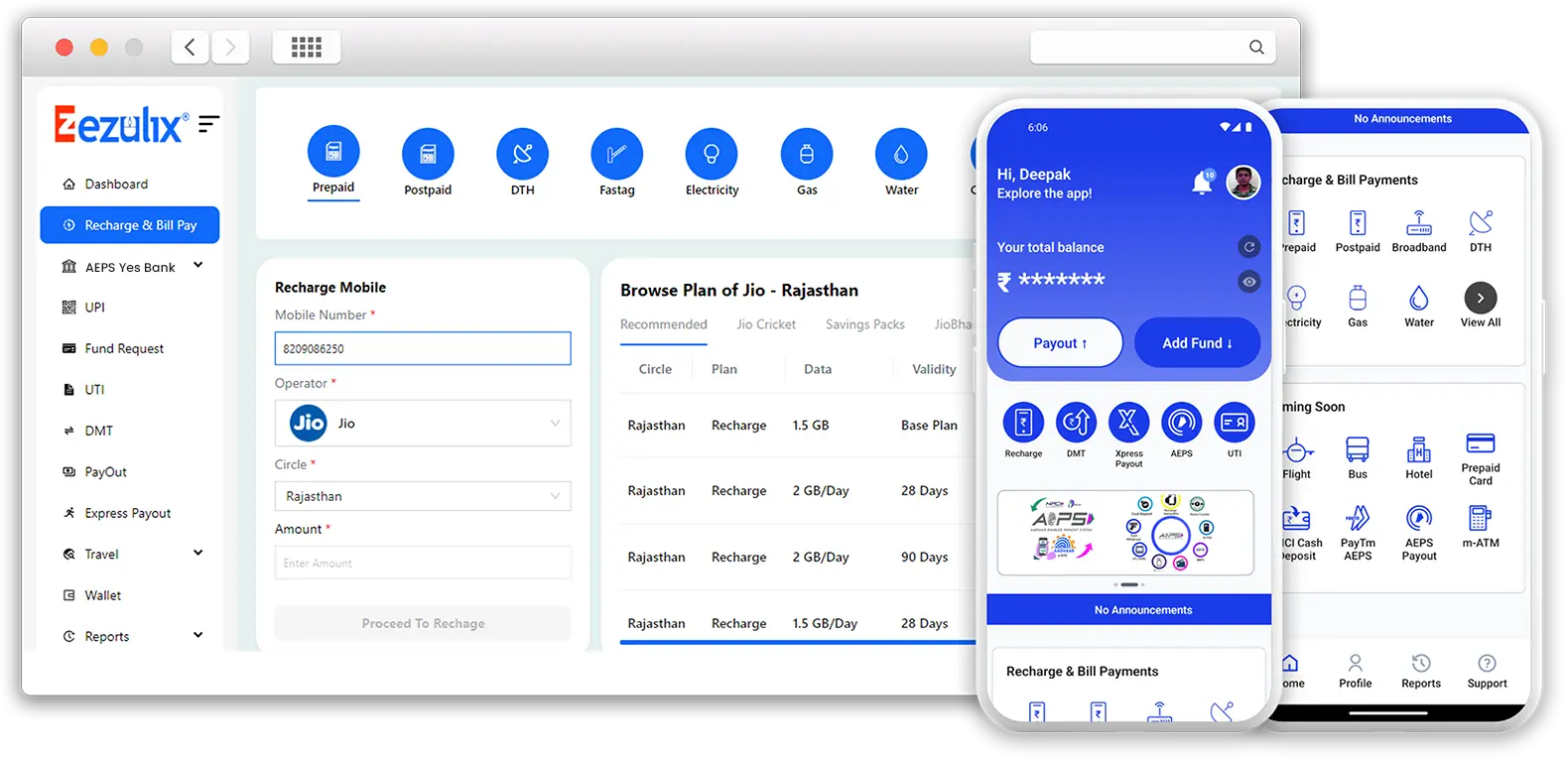

We provide a robust AePS Admin Panel in addition to the AePS Distributor Panel as well. In fact, we have taken care of the 360-degree needs of the AePS business. So, we provide you with Admin side features along with the user-side features. In this way, you get a complete solution from our side.

In addition to AePS software, we also provide a tailored website for your FinTech business. You can bring your business ideation to us and we shall provide you with complete branding, logo designing, and website development services. So that you can establish yourself as a brand in no time.

We are a dedicated AePS Software Provider and we can also provide iOS and Android-compatible AePS Mobile Apps. Our AePS Mobile App Development services are not restricted to only iOS and Android platforms, rather our mobile apps are also proficient as cross-platform and hybrid mobile apps.

So, are you an AePS Service Provider Company? Well, if so, then we are ready to serve you 24*7. Your hunt to find a top-notch B2B AePS Software Development Company rests at Ezulix. We provide top-notch AePS Software Development services and ensure to development of feature-rich software solutions.

We provide highly robust features for the AePS Admins so that they can offer their members a seamless Aadhar-enabled Payment System. Here is what we can offer to your members

We develop AePS Software tools for Admins that offer fast and secure cash withdrawal features with simplified Aadhar Authentication. All that the end-user has to do is to take his Adhaar Card at the Subordinate and cash withdrawal is done. You as an admin can provide these simplified cash withdrawals.

AePS Service Provider Admins can also provide Balance Enquiry features to all of their members through Ezulix AePS Software Development services. With the Adhaar Card only, the end users can have their balance enquiry and you as an admin will be in charge of this feature.

Admins may now offer their members with anytime, anywhere real-time mini statement downloading feature through your AePS admin panel. All the people associated with the AePS Software system can access their mini bank statements anytime through the Admin portal.

Let your members have cardless payments and withdrawals through their Aadhar cards with an easy-to-use Aadhar Pay feature. The AePS end users will be able to withdraw cash from their bank accounts just with the help of their updated Adhaar Card even if there is no bank branch near them.

Gift your members with Micro ATM services. Your idea, our devices! Ezulix also provides a complete infrastructure to implement the Micro ATM scheme in your area. So, set up your micro ATM systems today with us and start providing uninterrupted transactions everywhere.

We also developed a comprehensive AePS admin portal for the AePS service provider company that simplifies the bulk payouts for their members. So, the admins can release bulk payments without any restrictions and operate independently.

We’re are an all-in-one place AePS Software Company and we also provide mini but mighty FinTech and AePS Software APIs that can quick-fix your additional requirements. Here are our Tiny-Mighty APIs that can make your AePS Sofware more functional:

Releasing commission to the distributors was never this easy for the Admin. However, Ezulix has made it possible with our seamless Payment API integration. The admin can release commission payments through multiple options such as UPI, Net Banking, Debit Cards, and Credit Cards. So, enjoy making payments as effortlessly as on an E-Commerce platform.

Without Adhaar Verification conducting any online payment or banking transactions is impossible. However, being a comprehensive AePS Software Company, we have taken care of all the associated people and none will have to stand in long queues for Adhaar or PAN verification and KYC. Through the AePS Admin Portal, both the admin and the subordinates can do the KYC.

Our AePS software is not just about money withdrawal. Rather, the AePS software enables the users to hold each and every banking transaction such as mini statement download, detailed statement download, online money transfer, passbook view, adding beneficiary and many more. Connect any Bank’s API with the AePS software and serve as a link between the bank and their remote customers.

Every banking transaction has to be acknowledged through an SMS to ensure the end-user and also keep him updated on his banking transactions. When banking transactions take place on a daily basis, bulk SMS has to be sent. Therefore, we have developed a powerful bulk SMS API that integrates with the AePS software admin panel and the subordinate dashboards seamlessly.

We are the only AePS B2B Software Development Company that follows an admin-centric approach and creates value for members simultaneously. And here is how we effortlessly cater to the diverse needs of AePS Admins and members.

As a comprehensive AePS Software Development Company, we are aware of the importance of User Experience. Therefore, we craft a simple User Interface for your rural and remote audience.

As a dedicated AePS B2B Software development company, we primarily follow an AePS Admin-centric approach and offer complete manageability on the AePS admin portal.

Being a dynamic and highly adaptable AePS software development company, we offer a flexible and highly customizable AePS admin panel so that the admin can personalize the portal at any time from anywhere.

Why restrict your AePS Software to traditional features? Let Ezulix integrate the industry-best unique APIs into your AePS business model that can make your business stand out!

Get insightful transaction reports and analyse your member data to drive endless benefits from it. Ezulix is an AePS software development company that offers an embedded transaction tracking feature for the admin panel.

Being Admin-centric, our AePS software tools allow the admin to track each member effortlessly. So that the admin can have a complete hold on the members.

AePS B2B Software Development was never so flexible enough before to allow the admin to pick and drop a particular service at any time. However, Ezulix now offers a start-and-cancel-anytime facility to the admins.

As a B2B AePS Software Development company, we understand the importance of payment success rates. Therefore, 100% transaction success is our guarantee every time!

What makes us more special as an AePS Software Development Company? Well, we enable admins to have a 24*7 real-time settlement into a bank account by using Ezulix's latest AEPS B2B Software. So, choose our services and outshine the competition in the AePS Software industry Market. Get the best solution for your business and optimize the workflow like a pro.

Excited? So we are to serve you! Enjoy

AEPS, Recharge, Money transfer, Bill

payment services using a single wallet now with Ezulix AePS Software Development services.

What made us successful as an AePS Company is our systematic approach to development. Ezulix has been providing AePS Software Development services for the past 10+ years. However, we started our research and development 2 years before the launch.

In this way, we’re a 9+ year old AePS Software Provider in India. During our tenure, we are now skilled in systematic development. Here is how we proceed with our AePS admins-

Being a custom AePS Software Company, we believe in the most authentic and detailed requirement gathering. Therefore, we first listen carefully to the needs of the aspiring AePS admin and gather their requirements over a cup of coffee. However, if the admin wishes to connect over a call, we are comfortable with the call as well.

Once, we have fully understood the requirements of the admin, first we develop a prototype using Figma. In the prototype document, the admin would get a graphical idea of the design, user interface, and functioning of the AePS Admin Portal. At this stage, the admin has complete flexibility to alter, enhance, or improve the design.

When the admin has provided us with valid feedback on the AePS Software Prototype, then we start incorporating the same in the Figma Design (prototype document). Then, we again share the prototype with the AePS admin and until the Admin is satisfied with the design and functionality, we do not start the customization process.

Our AePS Software is a ready-to-use software product though, but as the same size does not fit all, the same AePS solution can suit every business model. Eventually, we do not ‘develop’ a new AePS software, rather we customize the existing one as per the Admin’s project requirements. Admin can get the APIs of his choice and he can add or drop any other features.

However, our AePS software is totally tested and has been working efficiently for the past 10+ years. However, after customization and different API integrations, a reliable AePS Software Company is liable to test the software again. Therefore, we re-test the customized software product through manual and automation procedures and deliver the product only when it passes all the quality standards.

We do not leave the businesses to fend for themselves. Rather, we are together with you in your FinTech journey. So, we provide robust training on using the AePS Software. Our team will explain each and every feature to the admin. From registering distributors to accessing their individual transactions and drawing data insights for business planning, our team will help you learn everything in detail.

The Tech industry is dynamic and ever-evolving. Therefore, every software requires regular updates. Additionally, being AI-driven, software tools also require regular updates and sometimes troubleshooting management. We’re a full-service AePS Software Development Company in India and hence we provide lifetime technical support to all our admins.

We are an 10+ years old IT company that started specifically as a FinTech. AePS Software was our pioneering FinTech solution that proved a blockbuster hit. The tremendous success of AePS encouraged us to develop more FinTech Software and we developed 5 more similar projects.

All our software tools in the FinTech industry have proved successful. Today, we have continued to grow as a FinTech and dedicated IT company in the digital realm crafting the best AePS Software in India. Here are some of the qualities that make us stand out in the crowd.

Unlike other AePS software providers, AePS is not our later-evolved product. Rather, we started our business as an AePS developer. Therefore, we bring 10+ years of expertise in one software solution. Get fully developed, thoroughly tested, and robustly performing AePS Software! Old is Gold, dig some!

We house 100+ dedicated team members comprising AePS Software developers, testing engineers, technical support engineers, and UI/UX designers. Therefore, the AePS software admins receive dedicated services from us and we’re ready to serve our associates 24*7.

We are an AePS Software Development Company that is registered with the National Payments Commission of India (NPCI) and hence we can ensure completely secure payment gateways. Also, our digital solutions adhere to the standard privacy policies and the users’ data is safe with us

“We’re grateful for our growing community of partners who amplify our impact and help ensure that empathy and possibility replace labels and assumptions.”

Get the AePS Software from us and start creating your subordinates. Provide Adhaar Enabled Payment Systmes at maximum doorsteps. The more subordinates you create, the more transactions will happen. The more transactions take place, the commission you earn! So, what are you waiting for?

Book a Free Consultation“Every Great, Big thing starts with a decision that you take today”

Don’t worry your data and business ideas are safe with us.