A Micro ATM device is a cost-effective, compact and easy to carry fintech device that is used to perform basic banking facilities.

If we talk about present times, millions of business correspondents are using the micro ATM machines at their shops to provide banking facilities as well as accept payment.

Micro ATM works similarly as AEPS service and operated properly in Aeps b2b software. Bank customers can perform basic banking services like cash withdrawal, and balance enquiry through micro ATMs.

A number of retailers are using micro ATM machines to accept payment also.

On the path to a cashless society, micro ATMs is the biggest plus for India.

This portable micro ATM device is designed in a way to easily carry, and efficient to perform transactions. Through this device, you can perform any bank basic transaction service.

In short, I can say this is very useful for us as it is helping in easy banking.

Table of Contents

How Do Micro ATM Device Works?

Micro ATM is a small fintech device that works similar to traditional ATM devices that why this is also known as mATM machine. It is also helpful to perform basic banking services If your bank account is linked with your Aadhaar card.

As we use unique Identity numbers to perform banking transactions through AEPS, in micro ATMs you can perform transactions through debit cards.

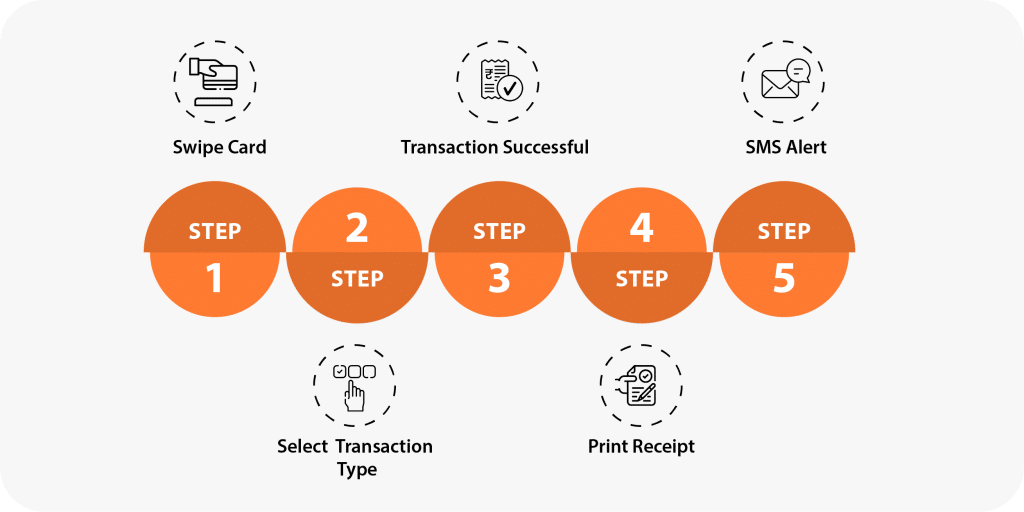

To perform cash withdrawal or any other banking transaction through a micro ATM device, you have to swipe your debit card. That’s why this is also known as a card swiping machine.

After swiping, you have to enter your PIN and submit.

These details go to banks under NPCI and if all details are authentic, transactions take place.

So this is a basic process externally that can help you to understand how it works.

But to perform all internal processes, the business correspondent needs a micro ATM app that helps this mATM device connect with the banking system.

What is Micro ATM App?

The Micro ATM app is an android application that helps to run and perform banking transactions through a micro ATM device.

To perform banking transactions, first, you to connect your micro ATM device with the mATM app through Bluetooth.

This micro ATM app is integrated with a fast, secure and easy to use micro API that allows it to connect with the banking system.

In short, this micro ATM app and device make a complete banking solution as combine. You can check out the benefits of a micro ATM device.

How Can I Start Micro ATM Business?

So now you have understood how micro ATM is important for people nowadays.

Someone said, always choose a product that everyone wants.

So If you are planning to start your own brand business and looking for the best opportunity, this is the best alternative for you.

You can start a micro ATM business and can make it a handsome source of Income.

To start a micro ATM business, you need micro ATM software and micro ATM devices.

Micro ATM software will help you to connect with unlimited business correspondents all over India while devices are used to perform service to them.

Choose Best Micro ATM Service Provider?

Choosing the best service provider for your business is a very important task. It decides the future of your business.

Ezulix software is a leading micro ATM service provider company in India. We have a huge team of professionals who works on creative and innovative technology.

Our team designed a micro ATM app is the way that helps you to start, run and explore your business smoothly and successfully.

We provide you with micro ATM software with advanced micro ATM applications and integrated micro ATM devices. It also helps you to boost your AePS transactions.

So this is also helpful in your business expansion.

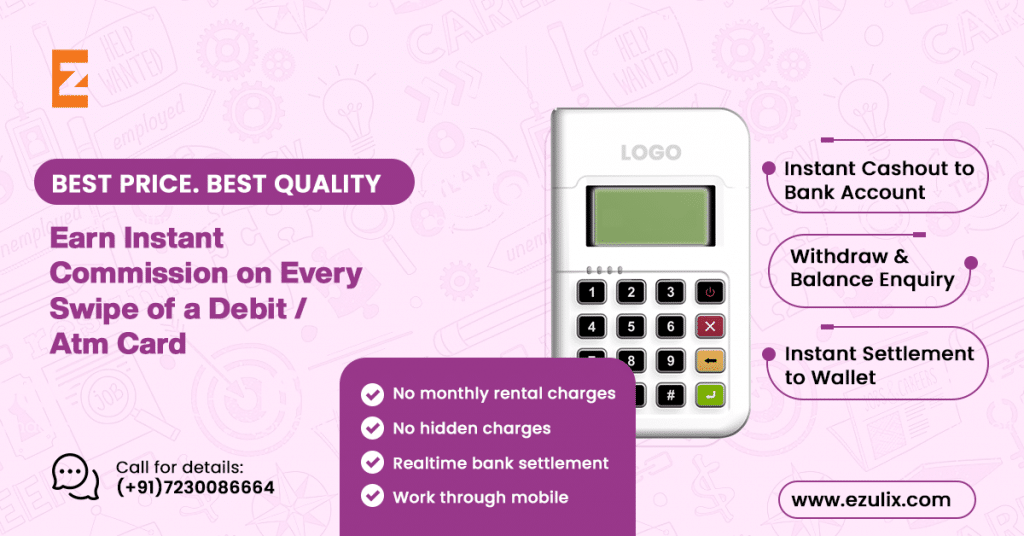

Our new mATM machines have an add-on mPOS feature. Now you can perform basic banking transactions using all credit and debit cards.

Ezulix Micro ATM Machine’s Price and Commission?

We provide you best quality micro ATM machines with advanced features. Single-day micro ATM transaction limit is 10,000/- under NPCI norms combined with banks.

If we talk about a commission, we provide you highest commission on all debit card swipes.(As per NPCI Guidelines)

It’s the last but not the least, micro ATM device price that you can’t even believe. Are you looking for the cheapest micro ATM price in India then you should book now?

Conclusion

So here we learned about micro ATM machines and micro ATM apps. Also, we discussed how you can start your own micro ATM business with best micro ATM service provider.

Along with micro ATM, we provide you with a wide range of b2b fintech software and APIs. It helps you to explore your business.

For more details visit my blog or request a free live demo.

9,652 total views, 1 views today